Key Points

- Ethereum™ and Ethereum Classic were once the same blockchain.

- The DAO was a contract that raised a lot of money, but it had a bug that was exploited. ETH was potentially lost to The Hacker.

- 70% of the lost funds were recovered, but 30% remained in limbo.

- In response, a Hard Fork was proposed, confiscating the remaining 30% from The Hacker by stopping their application.

- The Hard Fork was controversial as it was not fixing a problem with the Ethereum protocol itself, and Ethereum marketed itself on "Build Unstoppable Applications".

- A highly questionable "coin vote" led Ethereum Foundation to support the Hard Fork, breaking their neutrality.

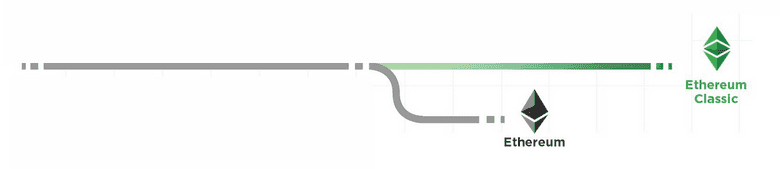

- The Hard Fork caused a chain split, resulting in Ethereum Classic.

- The Hard Fork was not necessary as the hacked funds could have been recovered on Ethereum Classic, but because of the fork this effort was abandoned.

- Having abandoned Code is Law, Ethereum™ finds itself in a philosophically questionable position when it comes to future interventions, which may be problematic.

- Ethereum Classic remains the longest running Smart Contract Platform, upholding the promise of "Build Unstoppable Applications".

Introduction

Future crypto historians will surely reference Ethereum Classic’s miraculous origin story as a case study that illuminates the sociotechnological fabric of blockchains. Like a Large Hadron Collider experiment, the incident that birthed ETC tore apart what was previously considered a more or less atomic entity, permanently splitting the Ethereum project in two, and scattering a cascade of valuable insights to observers.

ETC's story is fascinating and essential reading for any cryptocurrency researcher from a purely historical perspective. There is no story more relevant for those who are interested in really understanding what makes blockchains valuable. Against all the odds, despite the wishes of many, Code is Law and "Build Unstoppable Applications" ended up prevailing, and through the simple act of persisting, Ethereum Classic validated not just its value proposition, but the strength and tenacity of truly decentralized blockchains generally.

Advisories

Ethereum Classic's mission can only be adequately understood through the events surrounding its origin story, which by definition puts it at odds with its sibling Ethereum™ in several important ways. But these differences should not be misunderstood as pitting Ethereum Classic against Ethereum™ as a whole. On the contrary, the two projects have far, far more in common than what separates them. Both Ethereum projects share the same general ambition to change the world for the better; the difference lies in what each project thinks is required to achieve this change.

Ethereum Classic isn't anti-Ethereum™. Ethereum Classic is Ethereum.

Forgotten Details

In the broader Ethereum community, while the existence of Ethereum Classic is reluctantly acknowledged, the critical details surrounding its creation are largely unknown and seldom reflected on, as they reveal a truth that many would rather forget.

The details of this story expose a deeply rooted flaw in the Ethereum™ narrative. To some who are over-exposed to ETH, it poses a threat, which is one reason why Ethereum Classic itself is the target of dismissal, smear, and ridicule. But while the details of ETC's genesis may be inconvenient, the facts of history must be remembered. The details matter, as they warn about the perils of centralization and capture.

Those who cannot remember the past are condemned to repeat it.

As time goes on it will become increasingly clear that many critics of ETC are made uncomfortable by a simple truth. When Ethereum™ abandoned Code is Law, it also abandoned a major, if not the only, long term value proposition of blockchains. For many, Ethereum Classic is an annoying reminder of this lost value, but it will persist regardless and happily pick up the pieces when, once again, Ethereum™ is bent to the will of special interests.

Blame the Game

With this being said, and while coordination failures may have taken place in the past, there is no need for resentment towards anyone involved in or around the nascent stages of Ethereum. Far from it, all of those who contributed to Ethereum - forkers, anti-forkers, developers and non-developers alike - should be revered for their essential work in helping create one of the most significant achievements of a generation. Ethereum Classic owes a debt of gratitude to the Ethereum project and its creators.

There are points in this story that may suggest potential financial conflicts of interest, but these incentives are necessary elements of all blockchain projects and are to be expected, if not welcomed. In any case, as it is impossible to determine how much they did or did not play a part, all the individuals involved deserve the benefit of the doubt. Additionally, decisions made at the time were in all likelihood driven by honest disagreement about what would result in the best outcome for Ethereum, at a time when there was minimal real-world precedent to go by.

The creation of Ethereum Classic was a strange and largely unforeseen outcome. Rather than blaming individuals or groups, it may be healthier to view the birth of Ethereum Classic as a happy accident.

For these reasons, this reflection will intentionally avoid name-checking individuals, as should future discussion on the topic. Only organizations or high ranking executive positions will be identified when their roles are integral to understanding the situation.

The Original Ethereum Vision

In the beginning, there was "Build Unstoppable Applications" and for a time, it was good. It was a real revolution, as your average developer was able to create a new type of software that could not be stopped or censored by anyone. In the early days, there was unified support behind the concept of Code is Law within the Ethereum community. It was not just uncontroversial, but the mission itself.

The phrase "Build Unstoppable Applications" appeared on the official Ethereum website, which as we previously looked at, is a feature that depends on Code is Law. Unstoppability means that Smart Contract code is the ultimate arbiter of transaction outcomes, as opposed to courts or other forces outside the contract layer who would otherwise be able to stop or overrule applications.

Why are blockchains useful?

- You can run applications on them, and convince your users that your application will remain working even if you lose interest in maintaining it, you are bribed or threatened to manipulate the application state in some way, or you acquire a profit motive to manipulate the application state in some way

Rather than being subject to the whims of any one arbitrary party, someone using a blockchain technology can take comfort in the knowledge that the status of their identity, funds or device ownership is safely and securely maintained in an ultra-secure, trustless distributed ledger Backed By Math™.

Thousands flocked to the project based on this understanding and contributed time, talent, and money, united by the Original Ethereum Vision of "Build Unstoppable Applications". They told their friends, vouched for its integrity, and, thanks to this, the word of Ethereum spread like wildfire.

Everything was going well in ETH land. People were excited, new ideas were sprouting, projects were launching, and one of those projects in particular was soon to prove Classic.

The DAO

A DAO (pronounced "Dow Jones") or "Decentralized Autonomous Organization" describes a Smart Contract system that, much like a company, manages the distribution of funds for many stakeholders, and is usually governed by voting mechanisms. The idea of DAOs had been around for a while, but wasn't practical until Ethereum made it easy to program and launch them, which many teams began to do in 2016.

The Ethereum Foundation, who raised funds in a crowdsale to create Ethereum, had a Chief Communications Officer who announced the Ethereum Genesis Block and was an advocate of Code is Law. Like many others, EF's CCO saw the bright future promised by "Build Unstoppable Applications", indeed, it was ultimately their call to use this term to promote the Ethereum project.

In November 2015, the now former CCO teamed up with some coders and formed a company called slock.it. Slock.it wanted to launch not just a DAO, but The DAO, which would be used as a kind of venture capital fund targeting Ethereum projects. It was pitched as a way to grow the Ethereum ecosystem and net returns for investors, who would deposit ether into The DAO contract in exchange for DAO Tokens, which would allow voting for and yield rewards from investments made by The DAO.

Curator Cronyism

The DAO became big news in the Ethereum world, not least because it received significant backing from many Ethereum Foundation members. Aside from the project being led by EF's recent CCO, The DAO had recruited "curators", who were given the ability to veto specific actions and act as a fail-safe, in effect reassuring investors that funds would not be at risk from certain types of attack. All 11 curators had worked directly for the Ethereum Project or Foundation, including some notable heavyweights.

Officially, The Ethereum Foundation itself did not have any involvement with The DAO, but perhaps because so many curators had ties to EF, this position had to be made explicit.

Ethereum Foundation's attempts to distance themselves from The DAO are important to note, as despite these claims of neutrality, subsequent actions appeared to tell a different story.

The World's Biggest Crowdsale

At the time, many saw The DAO as a "no risk" investment, as not only did it have trustworthy curators, but investors would be able to withdraw their funds from The DAO in the future via a "split" mechanism; this further incentivized contributions as investors could "opt-out" later, but only had one chance to "opt-in" during the initial crowdsale.

Slock.it launched The DAO crowdsale in April 2016, and the ETH began to roll in, but soon, there were signs that something wasn't quite right. During the crowdsale, slock.it announced a security proposal, a curator called for a moratorium, and another prominent curator gave a warning and stepped down.

But despite these warnings, by the time the crowdsale was over, The DAO had raised an incredible $150 million worth of ETH, breaking all world records to become the largest crowdsale ever. This USD amount may not sound staggering by today's standards, but it was 14% of all ETH, which would be worth about $70 billion at today's market cap (as of December 2021, ETH had a price of ~$4,000).

"No Funds At Risk"

A week after the crowdsale ended, a security researcher publicly disclosed a new type of vulnerability that many Smart Contract developers had previously not considered, the so-called "reentrancy bug".

The bug can occur when a contract does not properly update its state when other contracts interact with it, allowing attackers to execute the same function many times over against the intent of the contract's authors. It is like a vending machine that does not check that a coin was inserted correctly; an attacker can tie a piece of string around the coin to pull it back out and use the same coin to sweep all the delicious goodies.

Because Ethereum was so new and best practices had not formed around developing Smart Contracts, this bug was quite common. Once the news got out, many contracts were exploited and funds were lost, but luckily, The DAO was not affected, according to slock.it.

...and it's gone

Just as with real world contracts, the devil is in the details, and it turned out that The DAO was affected by the reentrancy bug after all. On line 666 an exploit lay dormant, and that huge amount of raised ETH was sitting there waiting for a sharp-eyed programmer to nab.

A few days later, one or more attackers began to drain The DAO, and just like a piece of string tied to a coin, used specially crafted contracts to repeatedly call The DAO's split function to extract away more ETH than its contract authors intended to allow.

As a result of The DAO Hack, a significant amount of ETH had been extracted from The DAO at the expense of DAO Token Holders (DTH), who were likely to lose much of their original investment if nothing could be done to rescue it.

Altering the Deal

A critical point to note here is that The DAO Hacker did not exploit anything in the underlying Ethereum protocol, as the exploit was limited to The DAO contract. They also did not "break the rules" of The DAO contract either, as they simply interacted with The DAO in a way that it's authors did not anticipate. Regardless of the intent of it's author's, The DAO's Terms made it clear that the contract code itself was supposed to be the final judge. According to The DAO's authors, Code is Law.

The terms of The DAO Creation are set forth in the smart contract code existing on the Ethereum blockchain at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413. Nothing in this explanation of terms or in any other document or communication may modify or add any additional obligations or guarantees beyond those set forth in The DAO’s code. Any and all explanatory terms or descriptions are merely offered for educational purposes and do not supercede or modify the express terms of The DAO’s code set forth on the blockchain; to the extent you believe there to be any conflict or discrepancy between the descriptions offered here and the functionality of The DAO’s code at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413, The DAO’s code controls and sets forth all terms of The DAO Creation.

...

By Creating DAO tokens through interaction with The DAO’s smart contract code, you expressly agree to all of the terms and conditions set forth in that code. If you do not understand or do not agree to those terms, you should not Create DAO tokens.

...

The DAO’s smart contract code governs the Creation of DAO tokens and supercede any public statements about The DAO’s Creation made by third parties or individuals associated with The DAO, past, present and future.

...

The field of Digital Cryptography is very new and for this reason, there is a risk of unforeseen attack both in terms of the underlying cryptographic protocol that back the functioning of the DAO as well as 'game theory' related vectors which have not been documented to date. Both these vectors represent a risk that could lead the loss of DAO tokens or ETH in one or more or even all of the DAO Token Holder’s accounts.

Many share the perspective that investors in The DAO, having agreed to the above terms, were aware that risks were involved, and as such, just as they were happy to accept the upside that these risks might reward, must also have been willing to accept the downside consequences of those risks being realized. However, for many DAO Token Holders, this was not the case.

The DAO Wars

In a twist of fate, The DAO's split function had a time delay, meaning that The DAO Hacker would be unable to fully extract their loot until about a month after the initial attack took place, assuming that nothing prevented them from doing so in the meantime. This provided a window of opportunity for the Ethereum community to fight back against The Hacker and make DAO Token Holders whole, which became the primary focus for many.

There were several options on the table, but the main debate centered around whether it was acceptable to implement a "Hard Fork", a backwards-incompatible protocol change with the sole purpose of violating the promise of "Build Unstoppable Applications", to stop The Hacker's Child DAO and return the funds.

Would Ethereum stop the unstoppable? For many, this was unthinkable, but others thought it was the only way to undo a major injustice that could threaten the future of the entire network.

Robin Hood and His Merry Men

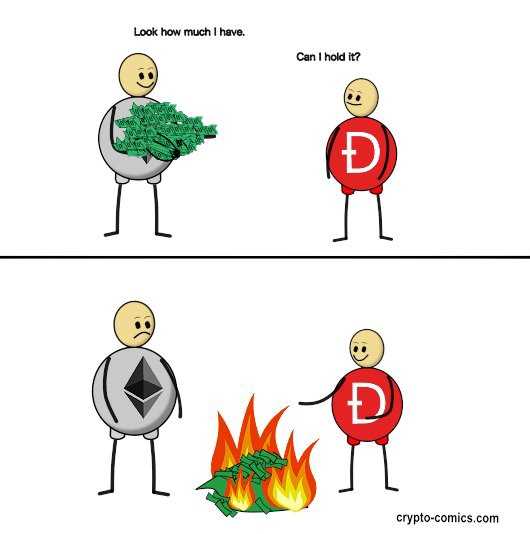

While the Hard Fork debate was unfolding, a group of noble whitehat hackers quickly went on the offensive and secured most of The DAO's Funds by using the same reentrancy exploit against The Hacker's split Child DAO.

Before a Hard Fork was decided, it was confirmed that 70% of the lost funds had already been safely recovered and a counter-attack could be performed so the remaining 30% would be returned or locked in a stalemate with The DAO Hacker. That remaining 30% could be split and re-split in perpetuity until one side gave up.

But even if [either a soft or hard] fork is not implemented, the community can stop the attacker from ever withdrawing their ether

...

One thing is for certain. This [counter-attack] can ensure that the attacker does not ever get any money out of this. From that point on, negotiations can continue with the attacker or a hard fork can happen to reimburse all the DAO Token Holders.

An unrealistic fear existed that The DAO Hacker would never back down and the 30% would be locked away forever. In reality though, it was just a matter of time before Robin Hood Group would be able to seize control of the remaining funds, as RHG could automate their side of the stalemate while pursuing other avenues to unmask or disrupt The Hacker.

The stalemate meant the whitehats had denied The DAO Hacker from receiving any significant windfall, and knowing that other avenues, including negotiations, chain forensics and real world policing could be used, The Hacker would eventually be forced to either give up voluntarily or face off-chain consequences that would prevent them from upholding their side of the stalemate.

One of the absurd but important details often forgotten about The DAO Fork is that it was unnecessary as most of the funds were already recovered, with the rest being as good as recovered. Without a Hard Fork, the worst case scenario for DAO Token Holders was a temporary 30% haircut, but as we will see, the implementation of the Hard Fork ended up causing a far worse outcome for not just DAO Token Holders but the entire Ethereum community and the culture of cryptocurrency as a whole.

UPDATE: This analysis has been proven correct as the identity of The DAO Hacker has since been deduced by researchers and members of RHG. Absent a fork, the pressure to unmask the hacker would have been much greater and likely happened much sooner.

To Fork, or not to Fork?

While this relatively modest worst case scenario was acceptable to many DAO Token Holders, anything less than the immediate return of 100% of the funds was not acceptable to an influential contingent, so The Hard Fork Debate raged on.

The Ethereum community was split into two opposing tribes: the forkers and the anti-forkers. The forkers were convinced that the best way to serve justice and "make DAO Token Holders whole" was to implement a Hard Fork. Any other opinion was unethical, and anti-forkers were portrayed as being antisocial and pro-theft, essentially accomplices of The Hacker.

One obvious problem that clouded the debate was a huge financial incentive for the many DAO Token Holders to support a Hard Fork. They were incorrectly led to believe that this was the only way to guarantee they would recoup their investment. Additionally, many influential figures, including the 11 curators, had endorsed The DAO and would lose face if they were seen not doing everything they could to make the investors they influenced whole.

Some pro-forkers incorrectly believed that to allow The DAO Hacker to get away with such large amounts of ETH would be to condemn the future of Ethereum, which would not be able to withstand a bad actor controlling such a large pool of funds in Proof of Stake. This was denied by the architects of Ethereum's Proof of Stake implementation, but was nevertheless popularized to bolster support for a fork, and is a myth that still lingers to this day.

The anti-forkers, on the other hand, argued that "Build Unstoppable Applications" must be upheld and that implementing a Hard Fork would not only break the promises made by the Ethereum project, but represented a moral hazard that opened up the door to future interventions. Some even warned that the nature of blockchains meant that controversial Hard Forks are guaranteed to result in a chain split, which could be catastrophic.

Anti-forkers also raised the point that the adverse effects of implementing a Hard Fork would be unfairly burdened by everyone on the network, regardless of whether they were DAO Token Holders. In contrast, the beneficiaries of the fork would only be a small subset of stakeholders. This "privatized profits and socialized losses" reality was reminiscent of the 2008 financial crisis, with the Hard Fork being referred to by many as a "bailout", with its various connotations.

In response to this concern, pro-forkers were incentivized to downplay the risks of a chain split, shelving it under the category of "don't worry about it, that's a conspiracy theory created by Bitcoin Maximalists". Moreover, any preparation for a chain split, such as implementing replay attack protection, or informing exchanges of this potential outcome to protect them from double spending, was not made, as to do so would affirm the possibility of a chain split and, in turn, make one more likely to happen.

Ethereum's Darkest Hour

As the Child DAO split deadline loomed, the debate quickly devolved into an extremely toxic argument fueled by financial interests and philosophical angst. The rift was so intense that accusations of criminality and lack of ethics were thrown from both sides. Any and all tactics were used to win the fight, which became an almost life and death battle.

The sad affair was topped off by threats of doxxing and other forms of retribution against those who were against a Hard Fork. Calls were made by slock.it to reveal the identities of those who opposed the Hard Fork, creating chilling effects and intimidating prominent anti-forkers against speaking out:

I'd be VERY interested to know the identify of anyone coordinating an effort to oppose a hardfork. PM me [redacted]@slock.it

Ironically, at the same time this witch hunt from was underway, The DAO's website, which was operated by slock.it, highlighted it's supposed values:

We, as a DAO, ascribe to the following values:

- Privacy and the right to anonymity

By now, the Hard Fork debate resembled a no-holds-barred religious crusade rather than a healthy discussion about what was in the best interest of the Ethereum project, but perhaps it was never about that to begin with.

Manufactured Consensus

Looking at The DAO Fork Debate on Reddit, we can see that a sizeable portion of the Ethereum community was against the Hard Fork based on upvotes alone. However, despite this, influential forces were involved that felt there was no other choice than to push for a Hard Fork to protect financial interests.

Unfortunately, it is probably impossible to get to the bottom of what the actual consensus was at the time, as the main forums of discussion - Reddit and Twitter - were highly susceptible to Sybil attacks in the form of astroturfing. Did the Hard Fork have genuine popular support, or was it just manufactured consensus? We will probably never know, but at the very least there was a significant pushback, and it cannot be denied what was going to be imposed on the community was a controversial Hard Fork.

The "Debate" Concludes

By the time the decision about whether to implement a Hard Fork was made, it appeared to be about far more than just a Hard Fork. It had become a familiar tribalistic power game where both sides were so entrenched in their positions, many were beyond reason and unable to concede.

As we will reflect upon later, through a game theory lens, the whole ordeal seemed like a coordination trap. From the beginning, economic incentives were aligned such that both sides were driven to "victory or death". As a result, forkers rationally downplayed the possible adverse outcomes of a Hard Fork while simultaneously making it seem like the only viable option, glossing over the reality of the situation thanks to Robin Hood's efforts.

The Totally Fair Coin Vote

During the debate The Ethereum Foundation attempted to maintain a stance of neutrality. Whatever was done about The DAO Hack, it was a question for the Ethereum community to decide, not something that came from the top. This was an important position to hold as deferring the choice would, on paper, resolve them of responsibility. However, despite this claim, clear evidence of a lack of neutrality among various wings of the Ethereum Foundation was shown.

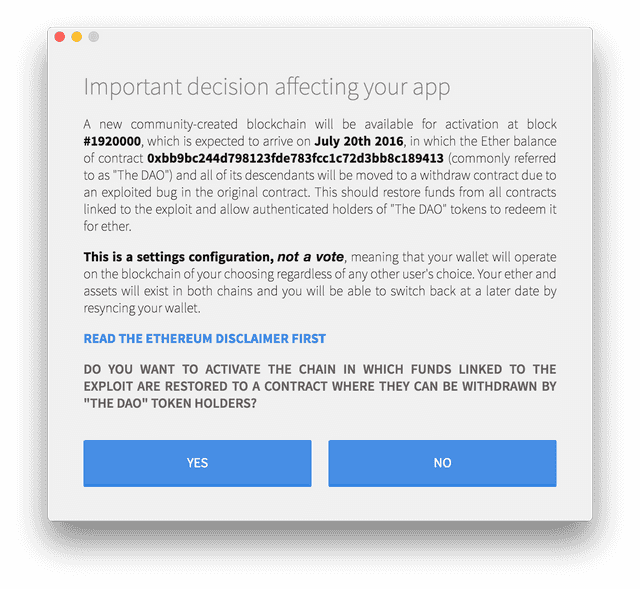

One problem with implementing the Hard Fork was that if users needed to opt-in with additional configuration, many node operators and miners would default to the "unforked" chain when they routinely upgraded their software, which would all but guarantee a chain split would occur and create problems. The "solution" was to update the default settings of the Ethereum clients to follow the new Hard Fork rules, and require users who wish to be on the unforked version of Ethereum to opt-out of the fork.

In a veiled attempt to maintain some level of neutrality, the decision of which default to use for Geth was made was based on the outcome of a controversial "coin vote".

Coin votes, where 1 ETH = 1 vote, are notoriously bad tools to reflect the opinions of a community, especially where those voting are financially incentivized. Suppose one whale has 90,000 ETH, and 10,000 dedicated community members only have 8 ETH each. In that case, the whale can guarantee a win and dictate the consensus of "the Ethereum community". Smaller position voters also have less incentive to participate as they have individually less sway, and collectively require a far higher level coordination, effort and gas fees to participate.

As it turned out, one single address voted with so much Ether that it amounted to 25% of all the votes. On top of this, this coin vote had no minimum quorum, and only 6% of total Ether participated. Most shockingly, it was announced and concluded within 12 hours, giving very little time to coordinate any response from anti-forkers, and made it impossible to get input from half the planet that was asleep.

Predictably, the results were heavily skewed by a handful of whales who may or may not have had foreknowledge of the announcement. The critical decision of which chain for Geth to default to was then claimed to be made "by the community" and was later used to justify Ethereum Foundation's support of the forked chain over ETC.

Commendably, in recent versions of the Ethereum.org website, the controversy surrounding this important coin vote is documented.

This course of action was voted on by the Ethereum community. Any ETH holder was able to vote via a transaction on a voting platform. The decision to fork reached over 85% of the votes.

It's important to note that whilst the protocol did fork to revert the hack, the weight the vote carried in deciding to fork is debatable for a few reasons:

- The turnout to vote was incredibly low

- Most people didn't know the vote was happening

- The vote only represented ETH holders, not any of the other participants in the system

While it was clear that some pro-forkers did not want Geth or any Ethereum Foundation products even to have the option of running the unforked chain, to provide neutrality, the infamous --oppose-dao-fork flag was added to Geth, enabling users to opt-in to the unforked chain by enabling this config parameter. However, it was soon removed in later versions.

To be fair, some other Ethereum Foundation teams attempted to provide genuine neutral choices. For example, Mist, the dapp browser, required users to make an explicit choice of which version of the chain to run when opening the client, rather than opting them into one side of the fork by default.

Unfortunately, the Mist client decision was far less consequential than Geth's, as the target user base for Mist was neither miners nor exchanges, so this option had no significant effect on hashrate or user adoption, which was primarily dictated by exchanges and other wallet services using Geth's new defaults.

Some Ethereum Foundation members even publicly spoke out against the Hard Fork, cementing the idea that consensus was not reached. To those who stood up for "Build Unstoppable Applications" despite the peer pressure, we salute you.

So Neutral, Much Consensus

Another smoking gun that points to lack of neutrality from The Ethereum Foundation surrounding the fork decision was evidenced in an announcement from the exchange Poloniex, which suggested that EF did not simply fail to warn exchanges about the possibility of a chain split, but, in private, were actively downplaying its potential, and, contrary to the discussion on Reddit, claimed that the Ethereum community had little to no interest in the unforked chain.

...repeated assurances from representatives of the Ethereum foundation that the community had little to no interest in Ether on the unforked chain...

Either way, ignoring rumors and conspiracy theories, the proof was in the pudding; those who pushed for the Hard Fork appeared very happy with Ethereum Foundation's "help" implementing such an effective solution.

As the Child DAO's split function deadline loomed, consensus was declared, and Ethereum™ would implement the unthinkable: a Hard Fork to change the rules of the game to try to undo the hack. The forkers had won the debate; or at least, they got their way. For now.

The Fork

On block 1,920,000, 20th July 2016, history was made. While the Ethereum™ website still proudly proclaimed "Build Unstoppable Applications", its authors changed the Ethereum protocol for the sole purpose of stopping The Hacker's Child DAO in its tracks. The forkers reached into the contract layer, punt kicked Code is Law out the window, rewrote The DAO's contract mid-flight, and confiscated ETH from The Hacker. Mission Accomplished!

Contrary to popular misconception, The DAO Hard Fork was technically not a "rollback", as it is commonly referred to - there was no "going back" to an old state. Instead, it was a "surgical irregular state change". In many ways, this is a far worse outcome than a rollback from a Code is Law perspective, as unlike a long reorg, this was the manual intervention of a contract, overriding its logic, changing the rules of the game, and inserting some arbitrary replacement code determined by a subjective off-chain governance process with next to no transparency.

On this new fork, where the contract layer had been desecrated, the promise of unstoppability was defiled, and Code is Law was dead. F.

The DAO Hard Fork was unlike the typical hard forks that happen reasonably frequently on Ethereum which involve protocol fixes or feature enhancements; there was no "upgrade" to the protocol from a technical point of view. Instead, for the first time (and for now, the last), the "upgrade" was political, and only concerned overriding something happening in the contract layer, which is distinguishable from the protocol and was marketed as being unstoppable.

The Chain Split

As if by some divine universal law, a dynamic of opposites is seen all throughout nature. The Light and the Dark, the Yin and Yang, the Decentralized and Centralized.

When its authors attempted to crush the Original Ethereum Vision, the universe provided an equal and opposite response, and on that fateful day, a miracle occurred. In a defiant continuation of Code is Law, the blocks of the original chain continued to be mined, following the Classic unforked protocol rules.

For the first time, the technology had properly demonstrated its ultimate dispute resolution mechanism. Through the chain split, all parties got what they wanted; either a version of Ethereum where Code isn't Law or a chain where the promise of "Build Unstoppable Applications" was upheld.

The DAO Fork was a sacred cleansing moment for Ethereum, a shedding of the corruption and centralization that allowed The Fork to happen. Those who didn't like Code is Law started a new chain with new rules, leaving the unforked chain to operate as it was, with less baggage, a refined community, and a clear mission.

In contrast to the newly forked Ethereum™, the unforked Ethereum was opposite in many ways; in it's unstoppability, it's level of decentralization and therefore in its unbounded potential to change the world.

Confusingly, the Ethereum Foundation determined that their new forked chain would be called "Ethereum". It would almost exclusively receive official support from the Foundation from then on, including the huge amounts of funding raised during the crowdsale. But the unforked chain kept something far more valuable, as Code is Law is not something that could be forked away on a whim, and the original chain they abandoned continued to chug along.

The longest running Smart Contract platform is, was, and always will be Ethereum Classic.

The Immaculate Conception

The emergence of Ethereum Classic was miraculous in many ways, both in circumstance and substance. Had it not been for Bitcoin, Ethereum, The DAO, The Bug on line 666, The Hacker, the Split Function Time Limit, the Hard Fork Debate Coordination Trap, the Hard Fork itself, and the brave and charming supporters of ETC, without this series of profoundly improbable events, the world would not be blessed with a truly decentralized Smart Contract platform that champions Code is Law.

Ethereum Classic also has many miraculous properties that are impossible to conjure artificially. With a commitment to Code is Law, no founders, no Ethereum Foundation, no premine*, a fair distribution, and a community that self-select based on concern for principles over convenience, ETC stands higher than even the Bitcoin Standard on many of the pillars of decentralism, giving ETC one of the greatest potentials of all blockchains for Sovereign Grade Censorship Resistance and the reality-bettering power it unleashes.

The circumstances of Ethereum Classic's emergence are so rare that they are unlikely to ever happen again. Ethereum Classic, being the first to demonstrate the power of Code is Law and the danger of pushing for controversial hard forks, serves as a warning to prevent similar situations from happening in the future, making ETC the only chain likely to achieve these properties, thanks to its original authors abandoning it.

The Resurrection

Three days and three nights after The DAO Hard Fork, The Original Ethereum Vision rose again, and Ethereum Classic got its first exchange listing on one of the largest altcoin exchanges Poloniex. After this first listing, ETC's future was sealed, as market forces would take hold, causing other exchanges to rush to list, and making mining the Classic side of the chain split liquid and profitable.

Two days later, a version of Geth was forked that defaulted to the Classic chain and removed The DAO Fork code. Three days after this, Ethereum Classic is officially supported by Parity, Ethereum's second major client. Prominent ETH miners quibble about whether to "51% attack" ETC to prevent its rise, but eventually decide to let it be.

The Declaration of Independence

The Ethereum Classic community quickly organized into a new decentralized emergent social order, launched EthereumClassic.org, and declared independence from The Ethereum Foundation.

Let it be known to the entire world that on July 20th, 2016, at block 1,920,000, we as a community of sovereign individuals stood united by a common vision to continue the original Ethereum blockchain that is truly free from censorship, fraud or third party interference. In realizing that the blockchain represents absolute truth, we stand by it, supporting its immutability and its future. We do not make this declaration lightly, nor without forethought to the consequences of our actions.

The Difficult Breakup

The now fractured Ethereum community, already war-weary thanks to the Hard Fork debate, was sent into overdrive by the emergence of Ethereum Classic. What many had hoped would be the end of the struggle turned out to be the beginning of another difficult chapter in a demoralizing development that was far worse than professed and anticipated just weeks earlier.

The chain split was far from painless. Had all the side effects been known in advance, it seems extremely unlikely that even the most ardent supporters of a Hard Fork would have considered it an acceptable solution, especially compared to alternatives that would not have caused a split. ETC was living proof that pro-forker assurances about a smooth Hard Fork were just wishful thinking. Having caused such a cock-up, who could trust their judgment again?

Chain of Thieves

The forkers, rather than accepting responsibility, proclaimed that this new "Classic" thing was trouble; it was an attack on Ethereum by Bitcoin Maximalists, an empty protest chain, a zombie that would disappear in short order, even a "chain of thiefs" [sic]. ETC was many things, but definitely not legitimate. Nobody that supported Ethereum™ could honestly support Ethereum Classic. That was heresy.

For many, those responsible for Ethereum Classic were "idiots", "crazies", "baddies", or worse, and they had to pay for their crimes. Much of this post-fork animosity was captured at the time by commenters, but to avoid picking at scabs, we strongly advise against googling the title of this section.

"Free Money" and the Ultrafair Redistribution

But the attacks against Ethereum Classic were not just limited to name-calling. Some believed it might be possible to destroy Ethereum Classic, sending its price to zero by dumping large amounts of ETC on the market. Of course, the reality is that blockchains are far more resilient than this, but that didn't stop attempts to wage economic war for fun and profit.

As a result of the chain split, every address that held Ether before the Hard Fork was now seeing double; they'd have the Ether they previously held, which became known as ETC, as well as an equal amount of the newly minted Forked Ether, appropriating the symbol ETH. Thanks to exchanges listing ETC shortly after the fork, a liquid market emerged that enabled price discovery between the two chains.

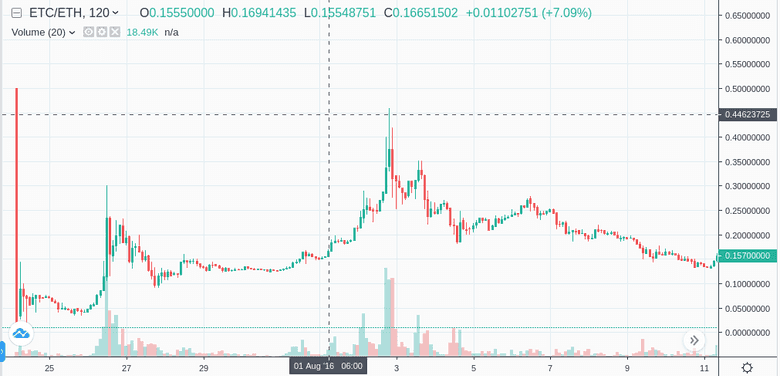

During these early days of price discovery many pro-forkers were keen to sell their "worthless" ETC at ridiculously low rates, dumping massive amounts of ETC under the assumption it was a "race to the bottom" of a dying market, pushing the price down to as low as a 0.01 ETH per ETC. This may have caused temporary concern, but it allowed diamond-handed supporters of ETC to pick up some once-in-a-lifetime deals.

This crescendoed in a market selling frenzy with prominent forkers claiming the selling of their ETC was "free money". To them, it was a no cost trade as ETC had no value, but in reality, they were participants in one of cryptocurrency's fairest market-based redistribution events ever. The "worthless" ETC was transferred essentially for free away from the ardent pro-forkers to those who saw a future in Code is Law, in what can be recognized today as an "Ultrafair Redistribution".

To the horror of many pro-forkers, after they had thrown away their ETC, the initial dump lost momentum, and the price of ETC came back with a vengeance. A week later, the price of ETC peaked at 0.4 ETH, giving the original buyers a 40x return and presenting the significant threat of "flippening" ETH, hugely delegitimizing the Hard Fork. Alas, the ETC/ETH flippening didn't quite happen back then and has yet to, but some predict that as time goes on the likelihood of this not happening approaches 0.

White Hat Group and their not so Merry Men

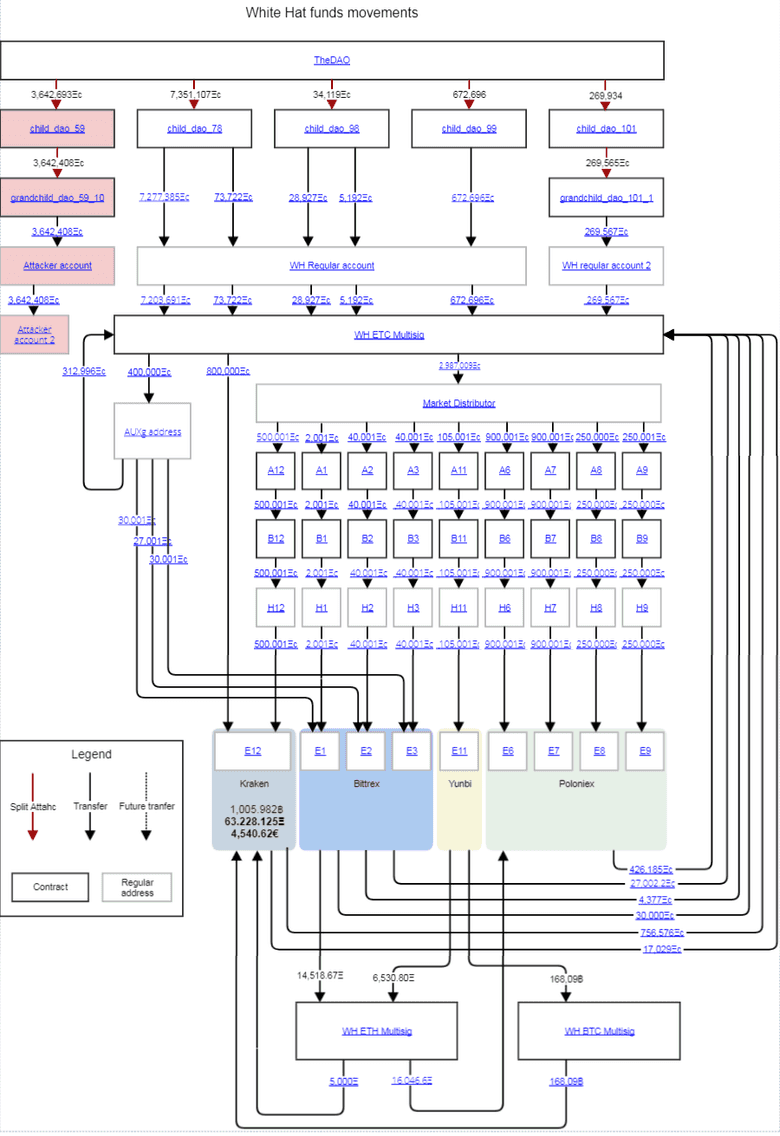

But hold on a second. Whatever happened to those funds that Robin Hood Group previously secured? As a quick reminder, Robin Hood Group had already secured 70% of the lost funds, now in the form of ETC. For the remaining 30%, they had sourced help from the community to acquire Child DAO "controller keys". They had the option of maintaining a stalemate of perpetual splits with The DAO Hacker.

After the fork, though, Robin Hood Group (RHG) handed over the wheel (and custody of the ETC) to a newly formed White Hat Group (WHG). Who was calling the shots for White Hat Group exactly is unknown, but the announcements that WHG were making were being published by a company called Bity, which happened to be partnered with slock.it at the time.

On the Ethereum Classic side of the split, the decision was made by RHG/WHG not to uphold their side of the stalemate, and they did not, despite requests, transfer the Child DAO keys to some other trusted group to continue the stalemate on their behalf.

RHG [...] could have continued the attack on the ETC chain using the aforementioned “DAO Wars” limbo strategy, but decide not to.

How they came to this decision was not made public, but it can only be assumed that it was partly fatigue, and the hope that the Hard Fork would mean the conclusion of the saga, but it may also partly have been a game theory play, where the goal was not to give ETC any legitimacy.

The strategy of not showing to make any preparations was the best way to reduce the chances of a chain split occurring in the first place, as acting as if the unforked chain would die out would, in theory, make it more likely to die out as it would be perceived to be abandoned. A Hard Fork was supposed to be the way to make DAO Token Holders whole, and to take precautions or chase the funds on ETC would undermine recent justifications for its implementation.

Whatever the intent, The Hacker's Child DAO was allowed to reach the deadline without being re-split, and this lack of action effectively meant handing over about 3.5 million ETC to The DAO Hacker, which is still in their custody today.

If instead of implementing a Hard Fork, RHG had simply continued the stalemate, not only would there be no need for Ethereum Classic, but DAO Token Holders would in all likelihood have reclaimed more value, which instead was lost in the form of ETC to The DAO Hacker and damaged reputation of the Ethereum project.

But the fun was just getting started.

The Failed Liquidation of ETC

Without warning or asking the opinion of DAO Token Holders, WHG, after first attempting to "tumble" the funds through several addresses to obfuscate the source of the ETC, deposited about 4 million (half of the 70%) on several of exchanges, intending to convert this ETC to ETH "on behalf" of DAO Token Holders.

This action sealed the deal for many who suspected that these "whitehats" weren't necessarily acting in a world of completely black and white ethics, and had motives over and above acting in the best interest of DAO Token Holders.

Their actions beg two questions:

- Why not give DAO Token Holders a choice in the matter, or at least open a discussion about what to do? Many holders did not support the Hard Fork, let alone wanting to convert their ETC to ETH. Indeed many still hold that ETC to this day, so clearly this action could not have been aligned with the wishes of all DAO Token Holders.

- Why try to tumble the ETC? This seems suspicious and serves little purpose other than to trick exchanges into not flagging the deposits. If all of this was legitimate, what is gained from obfuscation?

Only the most cynical of perspectives seems to adequately answer these questions, in that it seems likely that WHG was attempting to financially attack Ethereum Classic by extracting as much value from ETC holders as possible. By making no announcement beforehand, this prevented the market from pricing-in the dump and allowing speculators to protect themselves. The tumbling may have been an attempt to prevent exchanges from flagging the funds, which would alleviate the need to explain their actions to anyone ahead of time, which could allow the economic attack to be countered.

Thankfully, in yet another embarrassing development, despite the attempt to hide the true provenance of the ETC, the majority of these deposited funds were frozen by exchanges, and even the ETC that was liquidated was eventually traded back into ETC later when it became clear that WHG would not be able to execute their initial plan.

Though WHG provided a rationale for why they wanted to sell the reclaimed ETC, all of these excuses were shown to be baseless thanks to the subsequent implementation of a Withdrawal Contract on ETC, which eventually allowed DAO Token Holders to get their ETC back safely and decide for themselves what to do with it.

Replay Attacks

One effect of not preparing for a possibility of a chain split was the prospect of replay attacks, which could, both accidentally and intentionally, cause the loss of funds or theft from either side of the chain. The possibility of replay attacks was known in advance, but presumably to play down the possibility of a chain split being a concern, no action was taken to mitigate or even warn the community about them.

After the split, holders of ETH would have the same amount of ETC associated with the same addresses, and most transactions made on either side of the chain were valid and could be copied to the other. A signed transaction could be broadcast to the other side of the split and published to this chain without the knowledge or intent of the signer. This danger was not widely known at first, and it seemed that some clients would sometimes publish valid transactions to the mempools of both chains, creating chaos and causing innocent parties to lose funds in various ways.

One example of this mess was the case of contracts deployed to ETH but not to ETC. A value transfer sending ETH to a contract, say a multisig address, could be replayed on ETC, but the ETC may be lost forever as the receiving contract address has no private key, and no contract code is deployed to that address on Classic. In this scenario, no malicious actors were required, it was simply a preventable bad outcome caused by lack of preparation.

There were also documented cases of replayed transactions being exploited maliciously, typically with an exchange being the victim. For example, an attacker could deposit and withdraw ETH many times over, each time also withdrawing ETC from the exchange by replaying the exchange's withdrawal transaction from ETH to ETC, and as most exchanges had no idea ETC was or could be a thing, much of the ETC in hot wallets was ripe for the picking once opportunistic blackhats figured out the trick.

At the time, the only guaranteed way to prevent transactions from being replayed was to ensure funds were separated into different addresses on each chain, which could be achieved using a "splitter contract", but this was an annoying process especially for less technically inclined users. Several months later, a protocol-layer solution, EIP-155, was introduced. This is why EVM blockchains now respect a CHAIN_ID, a unique number for each chain that is specified when signing transactions, making them invalid on other chains.

Lessons Learned

Since the Hard Fork and its immediate fallout in 2016, the dust has largely settled, the animosity has faded away, and both Ethereum™ and Ethereum Classic continued to develop and have grown in their own ways. With the past behind, and the actions of individuals caught up on the whirlwind forgiven, the practical and moral lessons that The DAO Fork taught us must not be forgotten, so that similar future debacles can be avoided.

Coordination Traps

One significant takeaway from The DAO Fork debacle, which can now only be properly identified with hindsight, is the danger of coordination traps. This term is coined here to describe a phenomenon in a blockchain context, but the same concept echoes true in many systems where incentive structures yield bad outcomes.

Blockchains are designed to solve coordination problems, as Bitcoin and Ethereum did so by managing to, with nothing but a well-defined protocol implementing economic incentives, get millions of individuals to work together and, in short, do a bunch of cool stuff. But it appears that these exact mechanisms can, if left unchecked, contort and deform on their own and yield decidedly uncool stuff.

Looking back, it seems clear that The DAO Hard Fork was an example of a coordination trap, which caused individuals acting in their own immediate economic rational self-interest to engage in actions that on the whole were strictly worse for all involved. With hindsight, the events that unfolded don't make much sense given the poor outcomes, so why wasn't it obvious at the time that a Hard Fork was a bad idea?

The answer to this is complicated, but one theory is that the thinking of those who pushed so ardently for a Hard Fork was clouded, a combination of misplaced authority, poor foresight, and perhaps most influentially, hijacked amygdala thanks to tremendously high pressure financial stakes and tribal infighting caused by the game theory incentive structures around the Hard Fork debate, which discouraged any whiff of backing down and tapped into the warrior spirit.

The Hard Fork debate was essentially a complex game of chicken, and the forkers were led to believe they could only "win" if they doubled down on the idea that a chain split would not happen. So, they downplayed the possibility of a chain split and, to ensure a united front of confidence, intimidated and prevented others from making any plans to deal with one.

Having drunk their own Kool-Aid, many truly believed those who were against a hard fork or were warning that a chain split could happen were either allied with The Hacker or Bitcoin Maximalists who wanted to see Ethereum die. As a result, forkers, fueled by a rational desire but misguided strategy to protect their wealth, were willing to spread and consume increasingly ridiculous propaganda that bolstered support for a Hard Fork, which created a vicious cycle that compounded the effect.

The core misconception, which was reasonable at the time due to lack of past reference, was that the strategy of pretending a chain split would not happen would reduce the likelihood of a chain split happening. The hope was that if enough people could be influenced to abandon the unforked chain, it would die. As we know today, and after several prominent splits on other chains, this assumption has been proven incorrect, as it only takes a dedicated handful of individuals to continue a non-forked version of a blockchain, and market forces will merrily do the heavy lifting.

How can blockchain projects avoid similar disasters in the future? Strong philosophical underpinnings provide an antidote to this and other mad game theory quandaries. Principles act as a reference point that can nip the bud of the economic interests which would otherwise push communities into these traps. This is why principles are important and are upstream of everything for blockchains that expect to last. They can lay down the rules of the game socially, and inoculate a chain against a whole host of unforeseeable failure states that can occur when those rules are ambiguous.

Is Code Law?

To the layman, Ethereum™ still markets itself on Smart Contracts and the idea that their code should be the final arbiter of contract interactions. "Build Unstoppable Applications" was Ethereum.org's main slogan all the way up until 2019, many years after The DAO contract was stopped. The clear reality is that the usefulness of Smart Contract depends on Code is Law being upheld, as otherwise they can be censored arbitrarily by outside forces.

However, Ethereum™'s history suggests a questionable relationship with the concept of unstoppability and Code is Law. The direct contradiction of this concept in Ethereum™'s past means that the project is now in a schizophrenic position where it is simultaneously for and against the idea of Code is Law.

Some Etherians say that The DAO Fork was a one-off that will never happen again; Ethereum™ really does follow Code is Law, or at least it does since The Fork. The problem with this position is that, when it matters, Ethereum™'s history demonstrates that it is susceptible to intervention that can overrule Code is Law. If something can overrule Code is Law, you don't have Code is Law, you are just pretending to have it temporarily. Whether on a philosophical, social, or financial level, Ethereum™'s central points of failure have already shown it to be captured.

Other thought leaders in Ethereum Foundation say that Code is Law is an inhumane, sociopathic concept; future DAO Fork level "corrections" are on the table for Ethereum™, and that is a feature, not a bug. The problem with the Code isn't Law position is that it misunderstands the fundamental value proposition of blockchains, which are useful because special interests can't overrule them. For everything else, there are much more efficient options.

On top of this, despite the gaslighting that continues to this day, The DAO Fork was an objective dog's dinner, which only adds empirical evidence supporting the Code is Law case. Subjective intervention in supposedly unstoppable applications is inherently messy and must be avoided.

The Double Bind

For Ethereum™, major problems remain regardless of whether code is or isn't law; it is in a philosophical double bind. It cannot square the circle of its past performance contradicting its value proposition, and it is left with a dangling thread that increasingly tempts the kitten of fate the longer it remains unpulled.

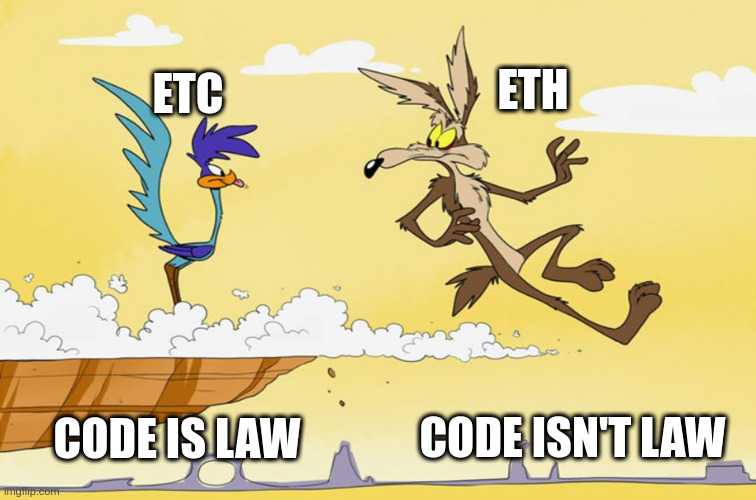

Like Wile E. Coyote running off the cliff, it is only a matter of time for the repo-man of unanswered questions to come knocking in the form of future DAO Fork level choices. Ethereum™'s current strategic ambiguity towards Code is Law may serve to appease interests temporarily, but it will in future simply cause much more significant problems down the road, when having a clear answer to the question of Code is Law will save a bunch of trouble.

In contrast with Ethereum Classic, in Ethereum™, the question "When should applications be stopped?" remains unanswered. For instance, whatever process determining whether forks should happen on Ethereum™ has decided that the victims of replay attacks caused by The DAO Hard Fork should not get another Hard Fork to make them whole, let alone all the major Smart Contract bugs and DeFi Hacks. Presumably, allowing these losses is a level of sociopathy acceptable to the Code isn't Law brigade.

Having this question remain unanswered is bound to create future issues and is the core reason why Ethereum Classic openly advocates for the principle of Code is Law in all circumstances. While it may not always be the most convenient position at any given moment, it is the only stance that can treat all participants neutrally, remain philosophically consistent, and therefore has the potential to stand the test of time.

Conclusion

The DAO Fork story shows how Ethereum was hijacked by a highly motivated special interest group, who forced through a misguided change on the network at everyone's expense. For Ethereum™, The Hard Fork was a disaster. Not only did it cause the community and network to split, forfeiting its precious Code as Law status, but in a bout of poetic justice, The DAO Fork ended up returning fewer funds to DAO Token Holders than the non-fork alternative that respected Code is Law would have.

The real, lasting damage that occurred was inflicted upon the culture of the cryptocurrency space far beyond the boundaries of Ethereum. Regrettably, a generation of new entrants do not care about or openly ridicule "Code is Law" as undesirable, and the ecosystem is set up for another massive The DAO scale failure leading to subjective interference in the near future, or worse, the censorship of users who depend on immutability.

Despite the chaos, one project, or more specifically, one philosophy, while it was far from evident at the time, did massively benefit from the Hard Fork; Ethereum Classic and Code is Law. In the end, the real "winners" of the vicious Hard Fork debate were the anti-forkers, who were proved right by the chain split and the return of recovered ETC, demonstrating that the Hard Fork wasn't necessary. Moreover, the moment it was apparent that The Original Ethereum Vision would not go silently into the night, it was settled; Code is Law prevails.

But hold on a minute, is this serious? Just look at Ethereum Classic's market cap compared to Ethereum! In what world is Ethereum Classic considered a winner?

To those who get Code is Law and understand the true value of blockchains, the answer to this is obvious. There is a world of difference between market cap and network value, and while the market can stay irrational for a long time, eventually all blockchains will face existential challenges that can only be overcome through an unwavering commitment to unstoppability. Slow and steady wins that race.

Having chosen to abandon Code is Law, Ethereum™ must live with this decision going forward, including during future crises where its abandonment may prove to be a fatal mistake. Luckily for humanity, though, Ethereum Classic will be there to pick up the pieces when this happens.

To understand how we must next take a closer look at what upholds the core useful property of blockchains, decentralization, and why ETC is in the unique position to maintain it for the long run.